The COVID-19 pandemic has changed the way people live, work and shop. Many urban dwellers have moved to the suburbs, seeking more space, affordability and safety. Remote work has also become more common, reducing the need to commute to city centers. These trends have implications for the retail sector, as retailers look for new opportunities to reach their customers.

A study on workplace mobility trends by the Canadian Chamber of Commerce’s Business Data Lab found that foot traffic in downtown Toronto, for example is still 46% lower than before the pandemic. Meanwhile retail leasing in Canada’s suburbs and smaller cities remains tight for tenants and good spaces difficult to find. With most people spending a couple of days working from home every week and the flight away from the city in search of more home affordability, more of the customers are captured where they live then ever before. Retailers know this and that is where they want to locate. However, there’s been a lack of new traditional retail development as a result of rising interest rates, rising construction costs and institutional landlord focus on the creation of mixed use communities.

Some retailers that have traditionally operated in urban areas are now expanding to the suburbs, following their customers. For example, Starbucks has opened more drive-thru locations in suburban markets, while Chipotle has introduced its first digital drive-thru order pickup concept in Port Moody, BC. Other retailers, such as Dollar Tree, Canadian Tire, Walmart and Costco, have benefited from their existing presence in the suburbs, offering a wide range of products and services to meet the diverse needs of suburban shoppers.

The shift from cities to suburbs is likely to continue for retail for an extended period, as many workers prefer a hybrid or flexible work schedule that allows them to work from home at least some of the time. According to a survey conducted by Mercer Canada, 54% of Canadian employers are adopting a hybrid working arrangement. A survey by AARP conducted in the US revealed that 66 percent of American workers 40 and up would only accept a new job if they are able to work remotely at least some of the time, and 79 percent say that flexible work hours are a job requirement for them.

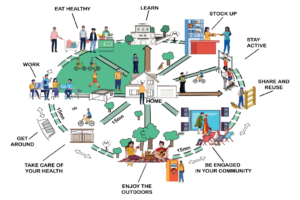

For retailers operating in urban and suburban areas, this means that they need to adapt to the changing preferences and behaviors of their customers. They need to offer a seamless omnichannel experience that integrates online and offline channels, as well as delivery and pickup options. They need to provide a safe and enjoyable shopping environment that follows the health and safety protocols and enhances the customer experience. They also need to leverage data and analytics to understand their customers’ needs, preferences and spending patterns, and to optimize their store locations, formats and assortments.

The Greater Toronto Area (GTA) and indeed, the Greater Golden Horseshoe Area (GGHA) is benefitting from the suburban retail trend, as these regions have a large and growing population, diverse and resilient economies, and a strong retail markets. According to JLL, the GTA’s population is expected to exceed 10 million by 2046, up from only 6.2 million in 2021.

Some of the suburban retail hotspots in the GTA include Vaughan, Markham, Richmond Hill, Mississauga, Brampton, Oakville and Burlington. These areas have a high population density, a high household income, a high retail spending per capita, and a high retail sales growth. These areas also have a mix of retail formats, such as power centers, community centers, neighborhood centers and street-front retail, catering to different customer segments and needs.

The suburban retail trend is not a temporary phenomenon, but a long-term shift that reflects the changing lifestyles and preferences of consumers. Retailers that want to succeed in the post-pandemic era need to embrace this trend and adapt to the new realities of the suburban retail market. Retail Developers and real estate investors have an opportunity to use creativity to build and retrofit more space at economical cost. The future is bright and opportunities abound.